Free Revolves No deposit 2024

February 13, 2025En iyisi vuruşlar tek kollu haydutlar ödül seçenekleri web kulübünde Karavanbet

February 14, 2025

Building Resilient Tokenonomics Models with AI

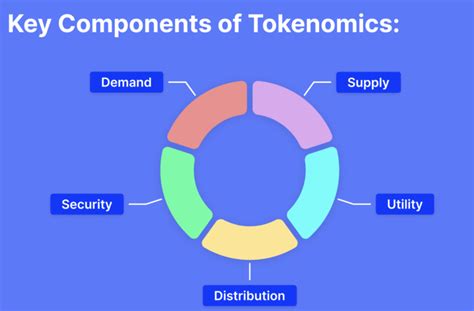

The world of cryptocurrency and blockchain is evolving rapidly, and one of the key components that can significantly impact a project’s success and growth is its tokenonomic model. Tokenonomics refers to the economic and social aspects of a blockchain-based project, including supply and demand, token distribution, voting mechanisms, and more. A well-designed tokenonomic model is critical to creating a sustainable and thriving ecosystem, but the increasing complexity of these models makes it increasingly difficult.

In recent years, AI has proven to be a game-changer in the field of tokenonomics. By leveraging machine learning algorithms and artificial intelligence techniques, developers can create more sophisticated and resilient tokenonomic models that adapt to changing market conditions and user behavior. In this article, we will explore how AI can help create resilient tokenonomics models.

Challenges of Traditional Tokenomics Models

Traditional tokenomics models rely heavily on human judgment and assumptions about the future success of a project. However, as a project evolves and new data becomes available, these models may become outdated and no longer accurately reflect the market situation. For example:

- Token Price Volatility: A sudden increase in demand for a particular token can lead to rapid price fluctuations.

- Supply Constraints: Limited supply or increased demand can drive up prices, but can also create supply shortages and limit adoption.

- Voting Mechanisms

: Motivating users to participate in voting processes can be challenging if the model is not designed with proper incentives.

Advantages of AI-Driven Tokenomics Models

AI technology offers several advantages when it comes to building resilient tokenomics models:

- Scalability: AI algorithms can process vast amounts of data and analyze complex patterns, making them ideal for processing large datasets.

- Objectivity

: AI models are not influenced by human biases or emotions, allowing them to provide more objective insights into the market situation.

- Flexibility: AI-driven tokenomics models can be easily adapted to changing market conditions, user behavior, and other factors that can impact the success of a project.

Types of AI Technology Used in Tokenomics Models

Several AI technologies can be used to build resilient tokenomics models, including:

- Machine Learning Algorithms: These are the core components of most AI-driven tokenomics models. They can learn patterns from data and make predictions based on that information.

- Natural Language Processing (NLP): NLP can help analyze textual data, such as project announcements or community discussions.

- Graph Neural Networks (GNN): GNNs are particularly useful for modeling complex relationships between different variables, such as the supply and demand of tokens.

Real-world examples of AI-powered tokenomics models

Several projects have already demonstrated the effectiveness of AI-driven tokenomics models:

- Chainlink: This decentralized oracle network uses AI to optimize its token price prediction model, ensuring that prices remain stable and in line with market conditions.

- Synthetix: This liquidity protocol uses GNN to analyze the behavior of various tokens on the Ethereum network and adjusts its trading strategies accordingly.

- DeFiChain: This DeFi platform uses machine learning algorithms to optimize the token price prediction model, ensuring that users can buy and sell tokens at optimal times.

Conclusion

Building robust tokenomics models using AI technology is an effective way to ensure the long-term success of a project.